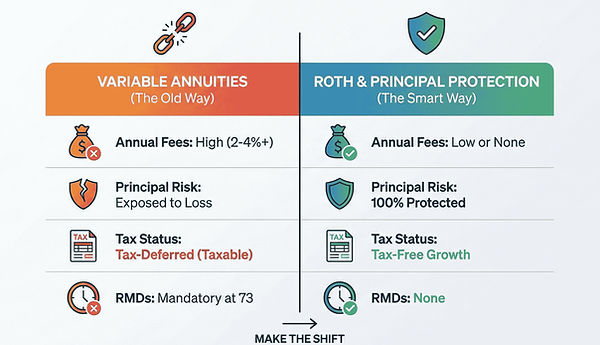

Variable Annuities

Variable Annuities often sound appealing, but the fine print tells a different story. While they promise market participation, the cost of admission is often detrimental to long-term wealth.

-

The Fee Drag: Between Mortality & Expense charges, administrative fees, and expensive riders, you could be paying 2% to 4% annually. That means your account has to grow by 4% just to break even.

-

The Principal Risk: Unlike other protected strategies, Variable Annuities often leave your actual principal exposed to market crashes. You risk losing your hard-earned savings exactly when you need them most.

-

The Industry Reality: There is a reason this asset class gets bad press—it often benefits the salesperson more than the retiree.

"We do not recommend this family of annuities. We believe your money should work for you, not for an insurance company's bottom line."

You Don't Need High Fees to Get Growth

Try These Solutions Instead

Strategy A: The Roth Conversion (Tax-Free Control)

Instead of locking money into high-fee products, consider unlocking it from taxes altogether.

-

Keep Your Gains: With a Roth conversion, you pay taxes now (on your terms) and enjoy tax-free growth forever.

-

No RMDs: Keep control of your money. No forced withdrawals at age 73.

-

Legacy: Pass a tax-free inheritance to your children, rather than a tax burden.

Strategy B: Principal Protection (The Safe Bucket)

If you want safety, choose instruments designed for it—without the 4% drag.

-

Zero Downside: We utilize strategies where your principal is contractually protected from market losses.

-

Upside Potential: Participate in market gains up to a cap, without risking a single dollar of your initial deposit.

-

Low/No Fees: Many of our preferred fixed-index strategies come with zero annual management fees, putting more money back in your pocket.